- Ny acknowledgment of a conveyance of real property code#

- Ny acknowledgment of a conveyance of real property plus#

Section 442.060 Private or public corporations may convey real estate.Section 442.040 Person under eighteen years of age may join in conveyance with adult spouse.

Section 442.030 Conveyance of property of spouse-covenants.

Ny acknowledgment of a conveyance of real property plus#

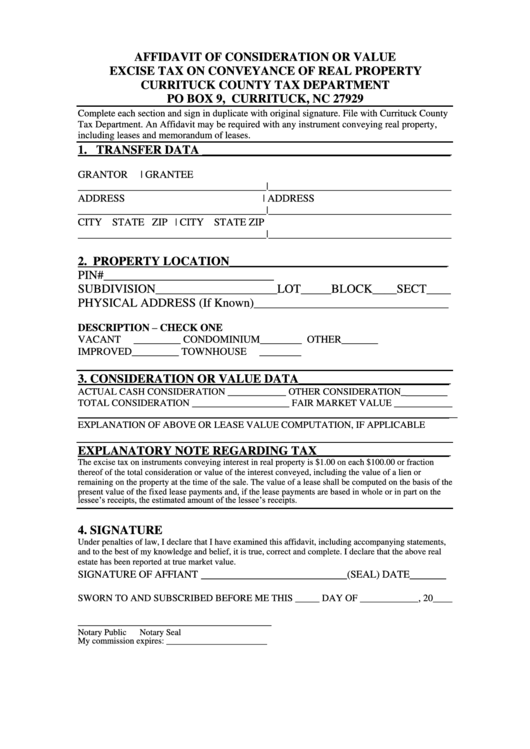

There is a convenience fee of 2.5% of the amount charged plus a. Make checks & money orders payable to: Niagara County Clerk. We accept payment in the form of cash, personal checks (up to $500.00), and money orders.EFFECTIVE MARCH 11, 2020: Real Property Law Section 291 “Recording of Conveyances” – A $10.00 fee will be assessed to all RESIDENTIAL DEEDS reflecting the following Property Class Codes: 200-299, 300-314, 322, 351, 411(c), 411(d).

Ny acknowledgment of a conveyance of real property code#

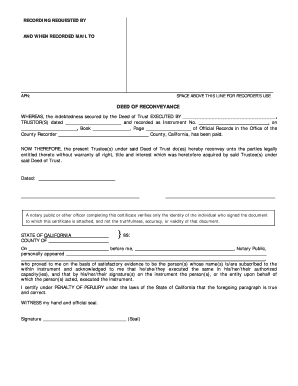

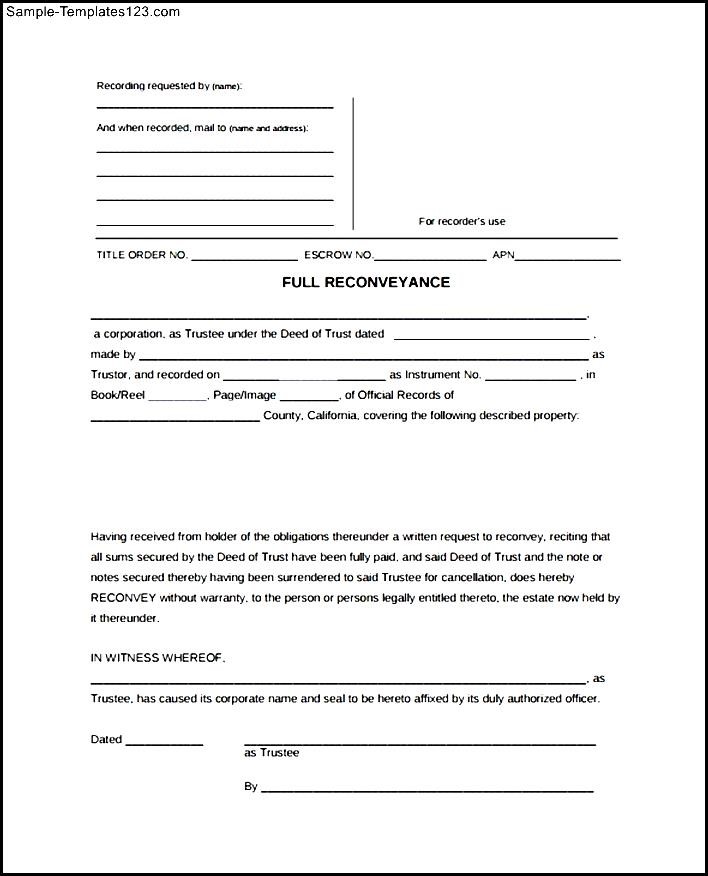

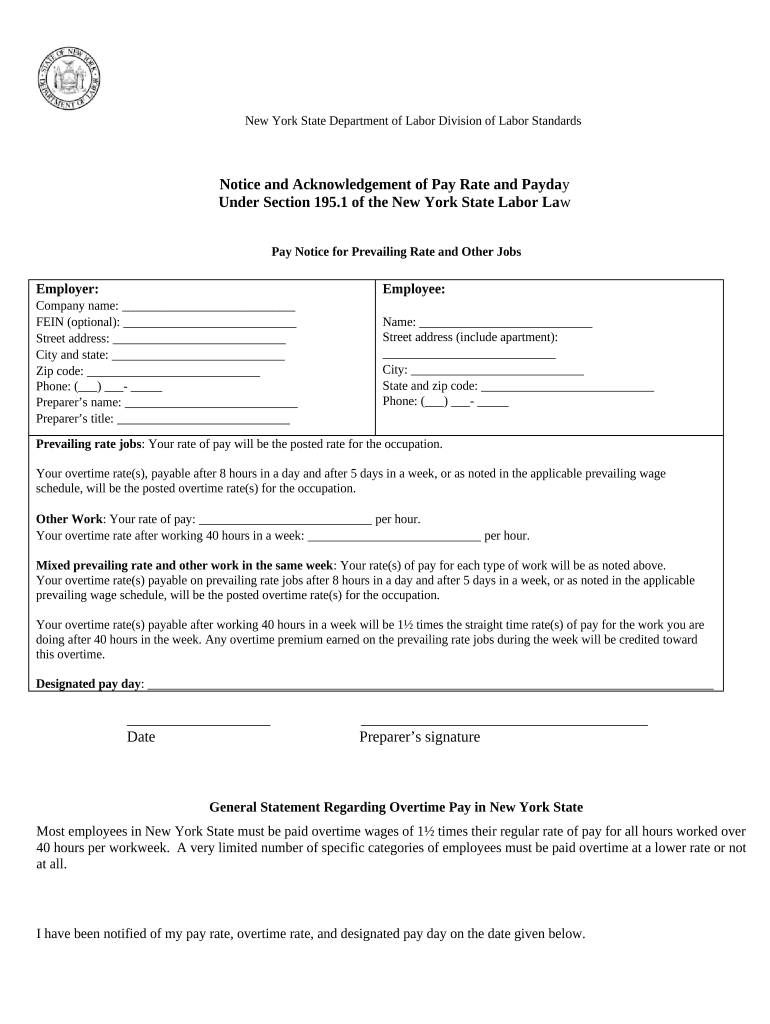

RP-5217: Filing Fee of $125.00 if the following boxes are checked: 7A, 7B, 7E, or both 7G and 8, or if the property classification code (Item 18) is 100-299 or 411C.Filing fee is $250.00 for all others.TP-584: The seller is responsible for payment of the $5.00 filing fee.$3.00 for each additional printed page or portion thereof. Recording Fee: $36.00 for a deed consisting of one side of one sheet of paper.The rate is $4.00 per thousand dollars of consideration. Transfer Tax: The seller is responsible for payment of the Transfer Tax.Fees The following fees apply to these transactions:.The form must be printed on size 8 ½ by 14 paper after completion. The Clerk's Office will only accept RP-5217 forms that have been downloaded and completed online. The form along with instructions can be downloaded at. RP-5217 (Real Property Transfer Report).This form must accompany the deed and be completed and signed by both parties.If transferring to or from a LLC, please review this link This form may be completed online and should be printed on size 8 ½ x 11 paper. Instructions for this form are available at. TP-584 (Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax).A TP-584 form must accompany the deed and be completed and signed by both parties.This acknowledgement has been in effect since 1999. Please note that all acknowledgments require Uniform Certificate of Acknowledgment. All names and addresses must be filled in on the document. The deed should have a legal description of the property. Blank deed forms can be purchased at many stationery or office supply stores. You may wish to consult your attorney for assistance. Deed An original deed form must be completed, signed and notarized.Recording Hours: Monday - Friday 9:30 AM - 4:30 PM.Office Hours: Monday - Friday 9:00 AM - 5:00 PM.

0 kommentar(er)

0 kommentar(er)